Will the US economy have a soft landing?

In 2023

- December 2023: HDFC Bank- when elephants dance

- November 2023: Corporate growth over the medium and long term

- October 2023: Margin of Safety – central to investing

- September 2023: Mid-caps and small caps are quite the rage in Indian markets

- August 2023: A look at the June 2023 corporate results

- Will the US economy have a soft landing?

- Nifty at an All Time High

- Growth has slowed over the last 4 years

- Competitive edge is at the heart of company selection

- As banks fail around the world, Indian banks seem safe

- Poor corporate governance can invalidate an investment hypothesis

- January 2023: Momentum Investing vs Value Investing

The last few years have seen some extraordinary monetary policy action by central bankers all over the world. First, there was the “open the spigots” mode due to the economic shock of the covid pandemic. The Fed funds rate came down from 1.5% – 1.75% in Dec 2019 to 0% -0.25% in Mar 2020 and the Fed also launched a massive Quantitative Easing (QE) program. The QE resulted in the Fed buying bonds worth about $4.8 trillion as the Fed’s balance sheet expanded from $4.2 trillion in Dec 2019 to nearly $9 trillion at its peak in April 2022.

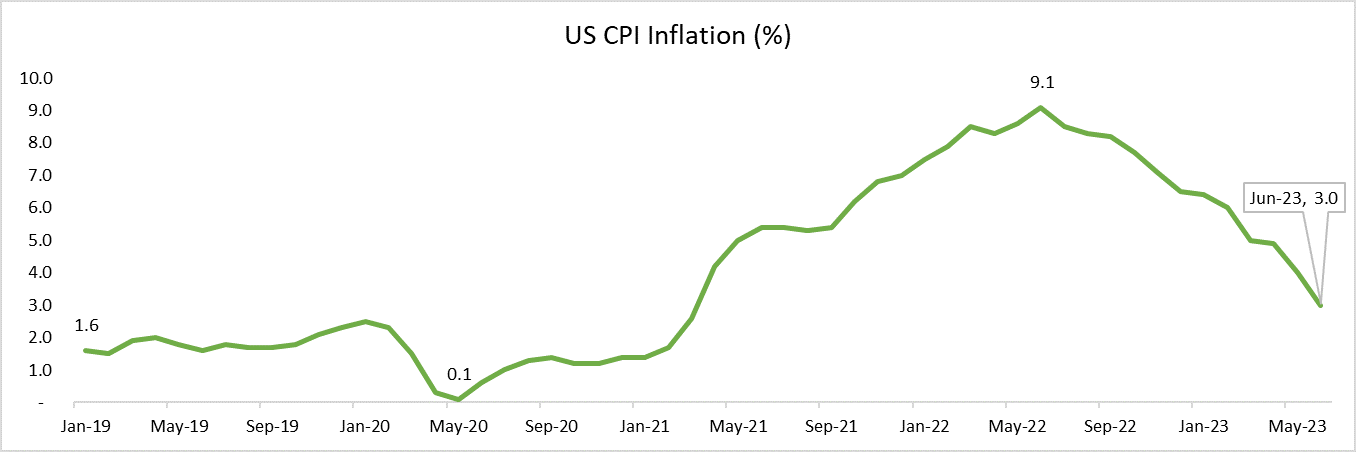

With the emergence of omicron as a less deadly variant, we eventually ended up with some sort of herd immunity and we hope we can say that we have seen the back of covid. However, as the economy returned to its more normal trajectory and because of some supply bottlenecks that persisted for some time, there was a burst of inflation from April 2021 onwards and the inflation rate in the US peaked at 9.1% in June 2022. It continued to stay elevated through the rest of 2022. What also contributed to the inflation was the Ukraine war and the resultant increase in commodity prices.

After saying initially that inflation was transitory, the US Fed launched a massive monetary tightening program starting March 2022 and over the last16 months, has increased interest rates by 5.25% to combat high inflation. The Fed funds rate is now at its highest point since 2001. Inflation has been cooling over the last several months and CPI inflation came down to 3% in June 2023, although the core inflation number was at 4.8%. What we must remember also is that the 3% inflation print is on a base of June 2022 when the inflation rate was 9.1%. Inflation in June 2021 was 5.4% – so in effect over 3 years, there has been an 18.4% increase in the price level for the average consumer. The total increase in core inflation from June 2020 to June 2023 is 16.0%. This lifts the price level higher on a permanent basis because the Fed is trying to bring inflation down to 2% – it’s not talking of negative inflation. This roughly 16-18% inflation over 3 years could have some impact on the consumption and savings behavior of Americans.

The S&P500 which had fallen from a high of 4819 in January, 2022 to a low of 3492 in October 2022, (a fall of 27.5%) has rebounded subsequently to 4582 and is now only about 5% away from its high in January 2022. What seems to be driving the market upwards is the expectation that there will be some sort of “soft landing” for the US economy. Most economists were expecting a recession in the US until not too long ago but now many are changing their tune to a “soft landing” scenario.

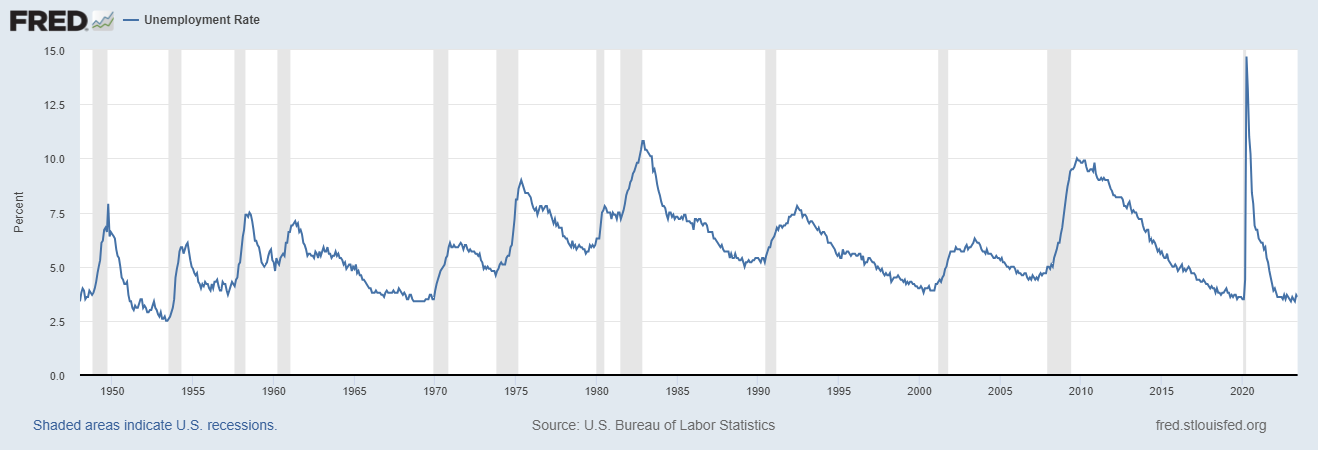

The reason for the optimism is that the jobs data has held up well. If we look at the graph below of the unemployment rate of the US since 1948, we find that the unemployment rate was at its lowest point for about 5 decades in April 2023 at 3.4% and has edged up to 3.6% in June 2023. Pre-pandemic too, the unemployment rate was about 3.5%. So, we are looking at historically low unemployment here, even after a 5.25% increase in the Fed funds rate over 16 months. While monetary policy tightening works with a lag, it is still remarkable how strong the jobs data is.

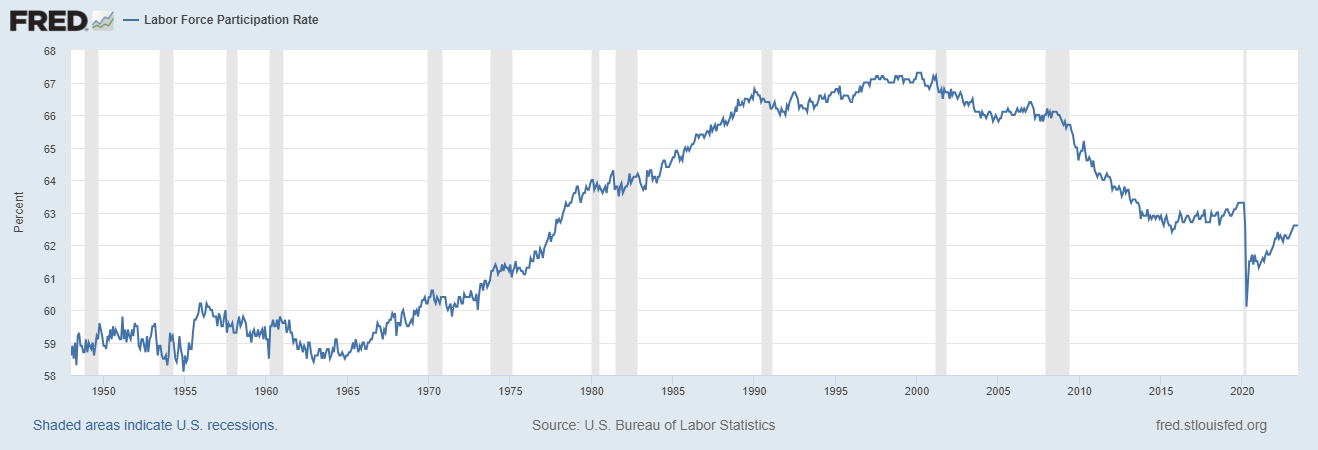

While talking of record low unemployment rate, we have to bear in mind that the labour force participation rate in 2023 is a lot lower than it was in 2000, as we can see from the graph below:

While the employment data continues to be robust, the economy will have to deal with the impact of sharply higher interest rates, tightening of lending conditions because of regional bank failures and a collapse in commercial real estate prices. The big question in everyone’s minds at the moment is whether the US economy will have a soft landing or will it go into a recession in the quarters ahead. The jury is still out on this one and it’s very hard to say which way the cookie will crumble. In the meanwhile, US GDP growth for the June 2023 quarter came in at 2.4%, against an expected 1.8%, which should give some hope to the “soft landing” thesis. You may be wondering – What does this have to do with me as an investor in Indian equities? Well, as the old adage goes – “When the US sneezes, the world catches a cold”.