June 2024: Risks to the market and our process to handle them

In 2024

- December 2024: The primary market – the raison d’être of the secondary market

- November 2024: A glimpse into Sep-24 quarterly earnings

- October 2024: Weak Market Internals

- September 2024: Implications of Fed rate cut

- August 2024: BSE500 constituents trading at elevated valuations

- July 2024: Higher taxation to impact intrinsic value

- June 2024: Risks to the market and our process to handle them

- May 2024: Corporate Results Trends over the last 10 years

- April 2024: Our investment process explained through AMCs

- March 2024: Market cap to GDP – where is India in terms of valuation

- February 2024: Patience – a virtue in the investment journey

- January 2024: Party continues for mid caps, small caps and PSUs

As markets both in India and the US stand close to lifetime highs, we thought we would devote this letter to the risks that may exist for investors. It is our duty to warn you about risks to your investments and also a regulatory directive. We know from history that there always prevails a boom-bust cycle in markets. All expansions are followed by a pause for a few years before the expansion begins once again. If we look at the US market as the bellwether for global markets, US equities have been on an upward journey since March 2009 (more than 15 years now) except for 6 months during the COVID-19 pandemic when markets fell precipitously only to rebound quickly.

The stock price of a company can be represented as a multiple of its earnings per share and the Price to Earnings ratio (PE). PE is a representation of how many times the company’s earnings the market is willing to value the company at. PE changes with time – it goes up during bullish periods and goes down when Mr Market is in a depressed mood. We are of the firm belief that the valuation of a company, depending on whether it is high or low, is one of the largest determinants of subsequent returns from the stock, the other of course being earnings growth. High and steady growth for a long period can overcome a higher multiple. However, we have seen in the instance of Infosys in March, 2000, the P/E went to as high as 322x FY2000 earnings, and despite delivering 35% EPS growth for the next 10 years, it was available at the same price as March 2000 in FY2010. So, in our belief, the valuation of a company does play a large part in determining stock returns over the medium to long term. Hence a high valuation presents one of the large risks for an investor in terms of their prospective return from a stock.

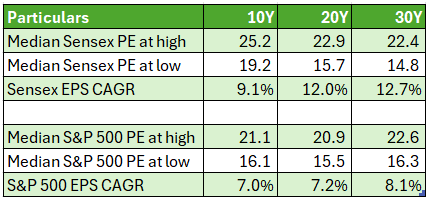

Below we present the Price-to-earnings range for the Sensex and the S&P 500 along with the earnings growth for 10Y, 20Y, and 30Y horizons. We have represented the median of the high value in any year along with the median of the lows each year.

The PE for the Sensex has ranged between 14.8x at the low and 22.4x at the high over the last 30 years and currently stands at 24.1x. The PE of the S&P500 has ranged between 16.3x at the low and 22.6x at the high over the last 30 years and currently stands at 25.7x. Earnings growth for the S&P500 has been in the 7% range for the last 10 and 20 years though the 30-year number is higher. For the Sensex, long-term earnings growth has been around the 12% mark and the last 10 years have been on the lower side, partly due to lower inflation and partly due to lower growth. The currently high PE ratios both in India and the US are pricing in strong growth into the future and if such strong growth does not materialize, the market is likely to be disappointed.

What has also been observed historically is that in a bull market the PE climbs over time and as is inevitable in life, high PEs are followed by low PEs. And once the market has bottomed out, valuations begin to rise again. There is an overlay of the earnings growth and high valuations can be sustained if the earnings growth is strong. This cycle tends to repeat over time.

How do we handle this volatility particularly in the valuation (we use PE as a simplistic representation of that) in terms of our portfolio process? We define a valuation range, based on historical valuations, that correlates to a price range for each of the high-quality stocks in our universe. This range changes with time as the quarterly and annual results of the relevant company flow in. This range guides us in terms of our buying and selling. Towards the lower end of the range, we are buying stocks and towards the higher end of the range, we are slowly selling the stocks in our portfolio. Our historical data suggests that our average holding period is about 3-4 years. Selling of the stock when it is at a higher valuation with respect to history, reduces the risk in the portfolio. As conservative investors whose first goal is to protect capital, reducing risk is paramount in our minds.

In the current environment too, where valuations are high, we have been reducing our holding in some stocks that are at the higher end of their historical valuation ranges and looking for other opportunities in our universe of high-quality stocks that may be trading at reasonable prices. However, as this bull market has progressed over the last few years, those opportunities have become more and more difficult to find. Therefore, many of our newer clients may find that they have a higher proportion of cash in their accounts because some stocks that we hold in our older accounts are not in the buy range for the newer accounts. If the market continues to move upwards, it is possible that these accounts with higher cash levels, may underperform over the short term but we are looking at outcomes over a 3-5 year period. The cash position in the portfolio is not the outcome of a macro level top down decision but is simply a resultant of whether there are enough stocks in our high-quality universe which are offering a good reward to risk ratio.

We believe that this process of selling what is expensive and buying what is reasonably priced should hold us in good stead if volatility does emerge once again. To reiterate, we have not seen a significant drawdown in global markets for any length of time for 15 years, bar the steep drawdown during covid for a few months. Regression to the mean is one of the strongest forces in the financial market. We believe that we hold good quality businesses and a large percentage of them are trading at valuations that are not excessive. While any volatility in the future would affect our portfolios too, but the strength of the businesses we have invested in, and the prices we have paid, should hold us in good stead over the foreseeable future.