December 2024: The primary market – the raison d’être of the secondary market

In 2024

- December 2024: The primary market – the raison d’être of the secondary market

- November 2024: A glimpse into Sep-24 quarterly earnings

- October 2024: Weak Market Internals

- September 2024: Implications of Fed rate cut

- August 2024: BSE500 constituents trading at elevated valuations

- July 2024: Higher taxation to impact intrinsic value

- June 2024: Risks to the market and our process to handle them

- May 2024: Corporate Results Trends over the last 10 years

- April 2024: Our investment process explained through AMCs

- March 2024: Market cap to GDP – where is India in terms of valuation

- February 2024: Patience – a virtue in the investment journey

- January 2024: Party continues for mid caps, small caps and PSUs

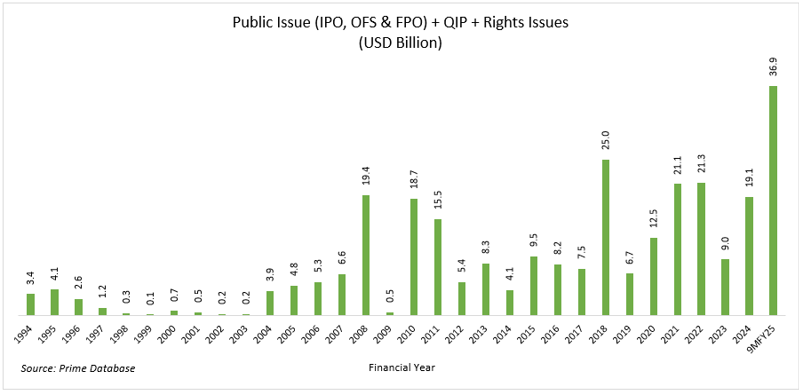

The Indian market has corrected since the high of September, 2024 and is now down for each of the last 3 months of the year. Strangely, this has happened only once before in 30 years and that was exactly 30 years ago in 1994. In this letter we examine the supply of paper or equity sales in the form of public issues (IPOs), and Qualified Institutional Placements (QIP), whether as fresh issue of shares or as sales by existing shareholders.

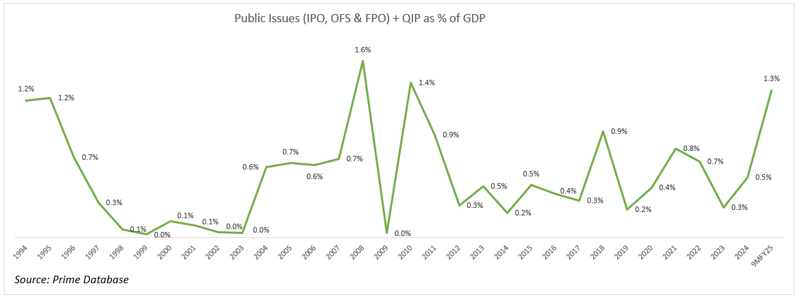

As we can see from the data, the maximum supply of paper comes to the market when markets are ebullient and this recedes when markets are less exuberant. We can also see this data as a percentage of GDP – the chart is presented below:

Each peak in this number has occurred close to a short- term market peak, whether it be 1994, 2008, 2010, 2021 or now. This is not surprising – the timing of equity offerings is determined by selling shareholders or promoters. It is logical that as people with better knowledge about their business and its worth, they act to maximize the price at which they can sell. The conditions for large public offerings in terms of the investor mood, are also created during ebullient conditions in the market. It is therefore not a surprise that we participate in very few IPOs, because usually the price of the offering is not right from a long term appreciation point of view. Also, our clients may be applying in some of the better quality issues that we may be interested in and that conflict also prevents us from investing in IPOs. Issues made during bear markets can be interesting sometimes. Also, many high-quality companies with different business models get listed over time through the primary market and some of these are good companies which enter our universe after careful examination. This increases the pool of companies in our universe which can become potential purchases in the future.

The primary market (the market where companies and existing shareholders offer shares to new shareholders) is the raison d’ etre of the secondary market (where existing shareholders trade their shares daily) and hence their respective names. The purpose of the market is to allow companies to raise equity capital from investors in order to fuel the growth of the economy and also allow new innovative ideas to blossom. Typically, this happens in the bull market phase. The bear market exists to provide efficiency to markets, so that the most capable and honest capitalists get access to capital.

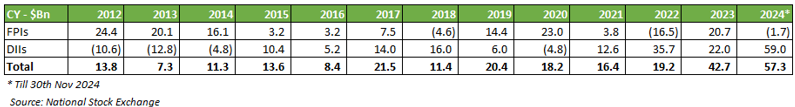

Now we look at the demand for equities. Below is a chart of the total institutional flows into the Indian stock market, split into FPIs (Foreign Portfolio Investors) and DIIs (Domestic Institutional Investors).

FPIs who were large buyers in the early 2010s, have been much more circumspect over the last 10 years. DIIs have been the dominant source of funds in the markets, powered by Systematic Investment Plans (SIPs) and other flows also from the public.

Valuations, as we have been saying for a while, have been on the expensive side, though we have seen some correction in that over the last 3 months. The September results indicated a slowdown in revenues and earnings for the corporate sector and we await the December results. The flurry of IPOs and QIPs while good from the long-term point of view in terms of the economy, in conjunction with the high valuations, suggests that it is possible that near term performance may not be as strong as it has been over the last few years. Another aspect of this is the rolling of time, because soon we will start looking at our companies from the FY2026 earnings and revenues point of view. If the companies one invests in, are growing their earnings at a reasonable pace, then the march of time will increase their value. We have used the correction in the market to invest some of the cash lying in the portfolio and we look forward to more opportunities in the coming months.