The primary sources of energy are oil, gas, coal, nuclear, hydro and other renewables like geothermal, biogas, wind and solar. The global energy markets are seeing a lot of interesting trade-offs between these primary sources of energy.

The median price of crude from 1861 to 1973 (adjusted for inflation in today’s currency terms) is USD 19 per barrel. Since the oil shocks of the 1970s when OPEC started flexing its muscle in the oil market, the median price has ratcheted up to USD 50 and consumers have been paying over USD 100 since 2008. Middle Eastern OPEC members whose cost of production of oil hovers around USD 5-10/barrel maximise their oil revenues by keeping the price of oil very volatile. They maximise their revenues by limiting the supply and thus extracting high prices from consumers and when any significant investment happens in extracting oil from fields in other geographies where the cost of extraction is high, the supply is increased where the price of oil falls below the floor at which these projects are viable.

Short term forces at play

The current sell off in the crude prices from USD 110 to USD 45 has triggered a lot of discussion about the bigger geopolitical or economic game being played by various players in the energy market. The theories range from:

- The Saudis wanting to pressure Iran in the Sunni versus Shia domination in the Middle East

- NATO led by US, using the Saudis and Kuwaitis to put pressure on Russia for its Ukraine move

- OPEC led by the Saudis wanting to make US investments in Shale oil and gas exploitation economically unviable

Long Term Historical Data

Any or all of the above might be true in the shorter term but let us try to understand how the global energy market has been developing over the past decades. British Petroleum annually publishes the BP statistical survey which details how we source energy globally. The detailed data is published annually and the data tables go all the way back to 1965 and the latest data is available till 2014. The data collated from BP statistical survey can be seen here (https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2018-full-report.pdf). Oil was the largest source of global energy and was increasing its share till 1973 when the world experienced its first oil shock – it then accounted for 48.4% of global energy needs. Since the multiple oil shocks of the 1970s, oil’s share of the global energy mix has been continuously and steadily declining ending 2014 with a market share of 32.6%. Even the prior oil market collapse in 1998-99, when the oil price nearly went into single digits didn’t help oil to gain market share in the global energy mix. Oil’s loss in market share has been incessant for the last 40 odd years.

Despite the shale gas revolution in the US, which increased US gas production by 30%, the share of gas in the global energy mix has remained flat since 2001. In fact the share of gas peaked out at 24% in 2012 and has marginally declined to 23.7% in 2014. Even if one were to look at the combined market share of oil and natural gas, as some oilfields produce both, that too has declined from 69.2% in 1974 to 56.4% in 2014.

Over the last decade and a half, coal has been gaining market share driven primarily by Chinese and to some extent by Indian consumption. What has also gained share is renewables (geothermal, biomass, wind and solar energy), which though is a very small part of the global energy mix at 2.5%.

Renewables Disruption in Energy Markets

In the context of oil’s continuously falling share of the energy mix, Ex-Saudi oil minister’s quote “The Stone Age came to an end not for a lack of stones and the oil age will end, but not for a lack of oil”, is very pertinent.

In a global energy market which has been growing at 2% p.a., renewables though have been growing at 15% p.a. for the past decade. This growth is driven by wind energy which has grown at 24% p.a. for the last decade and solar energy which has grown at 53% p.a. for the last decade. In the global electricity market which has been growing at 3% p.a., wind and solar have already become significant incremental players. Combined, wind and solar accounted for 18%, 24%, 28% and 33% of the incremental electricity production in 2011, 2012, 2013 and 2014 respectively.

Wind energy became commercially viable (i.e. can compete with grid power without subsidies) in early 2000’s and has maintained its growth rate at 20%+ since then. Solar energy is not commercially viable in most parts of the world without subsidies other than in few countries like Japan, parts of US and some Western European nations where the taxes on fossil fuel energy are very high. None of these countries other than some parts of US enjoy high insolation rates through the year. But the beauty of semiconductor technology where lot of innovation is focussed is that the prices keep falling. According to pv.energytrend.com the prices of silicon PV cells have declined from USD 76.67 per watt in 1977 to USD 0.30in 2015, i.e. prices have declined at 13% CAGR for nearly four decades. (http://en.wikipedia.org/wiki/File:Price_history_of_silicon_PV_cells_since_1977.svg). According to Citi Research and Bloomberg New Energy Finance, solar module prices have shown a learning rate of 22% since 1972, i.e. as the installed capacity of solar modules doubles the prices fall by 22%. This pace has further gathered steam since 2008 and the learning rate increased to 40%. As the technology becomes commercially viable, offering a larger and stable market (no uncertainties about tax exemption renewals) will offer the industry further economies of scale.

Energy Substitution

In the US due to the increased supply of shale gas which has depressed natural gas prices, the coal based power plants are being driven out of business as can be seen in the bankruptcy of Texas Utility, Energy Future Holdings (erstwhile TXU). In Germany, which has dynamic pricing of power, the increasing solar power generation is putting pressure on gas fired power plants which are used to provide peak loads as they can be backed off unlike nuclear or coal based power plants. According to Citi’s Disruptive Innovations Report published in May 2014, some gas fired power plants ran for less than 10 days in 2012 as solar power supplied most of the peak load. It is not uncommon in Europe where on sunny days in summer, to maintain the stability of the grid, power gets dumped across national borders, where the buyer of power gets paid.

Similarly energy substitution is taking place where CNG is substituting diesel and petrol as transportation fuel. Electric and hybrid cars are replacing petrol fired cars.

Game Theory of oil

The other interesting part of the oil demand and supply picture is the incentives of different producers. Saudi Arabia has among the largest proved reserves and more importantly, the cost of extraction is in the $5-10 range. Venezuela has world’s largest oil reserves at 298,000 m barrels(10% higher than Saudi Arabia), but the cost of extraction of oil in Venezuela is significantly higher. Meanwhile, while the average cost of extraction for shale oil is USD 65 a barrel, the marginal cost of operation is somewhere between USD 20 to USD 30 for several producers. Economics 101 tells us that a producer will continue to produce as long as his marginal cost is covered, in order to get as much fixed cost coverage as possible. While this is true for shale oil, it is even more true for the relatively higher cost producers like Russia who need to produce as much as possible to balance their budget. In this game theory of oil, Saudi Arabia holds strong cards because it is the lowest cost producer with one of the largest reserves.

Akal Badi ya Bhains

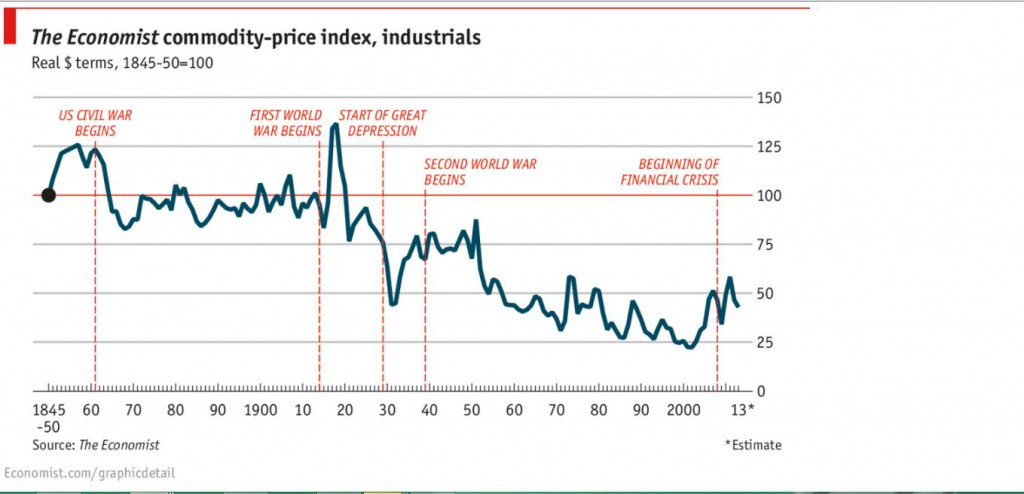

The Economist has been publishing the index of industrial commodities since 1845. The inflation adjusted commodity price index has been a downward sloping graph for over 150 years despite the increase in the consumption of all industrial commodities over time.

The reason for the decline in price is innovation and productivity enhancement. The Hindi idiom that encapsulates it is akalbadiyabhains, the literal translation is what is bigger brains or buffalo. The cacophony over the past decade of a lasting bull run in commodity prices is essentially the crowd thumping the table on the buffalo.

The oil market did not fit into the declining commodity index as the OPEC with it low cost of extraction, large reserves and dominant production kept the prices volatile in the oil market, offering only capital destruction for someone who took the other end of the trade. The long term impact of this OPEC policy has been to capture economic rent from the consumers and long term decline in oil’s share of global energy supply.

As we saw earlier energy sources are replaceable and the big substitution that is imminent upon us is renewables driven by solar capturing a higher share of the energy mix. Given that the prices of semiconductors keep declining, it will keep a lid on all fossil fuel prices and downward pressure with passing time. Long term the fossil fuel price chart too may look like the industrial commodity chart shown above.