Getting the price right

In this section

- Goals of an Investor

- Buying a high-quality company

- Getting the price right

- Competitive Advantage

- Behavioural Edge

As important as choosing the right company, is getting the price of acquisition right. We have seen historically that sometimes the price of a high quality company can become so expensive that even a decade can go by without the investor seeing any return from that stock.

For example, Infosys, a high quality company by any metric, traded at 320x FY2000E estimated earnings at the top of the dot com bubble in 2000. Subsequently, Infosys delivered 35% per annum earnings growth for the next 10 years. However, in FY2010 it was possible to buy Infosys at the same price (adjusted for bonuses and splits). So, despite impressive earnings growth for a decade, the buyer of Infosys at its peak in Feb 2000, did not make any return on their purchase.

"For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments."

Warren Buffet

We believe the price of purchase of a high quality business is a large determinant of the medium to long term return that you can hope to earn from that stock. We also believe that in the long term, stock prices are slaves of earnings – where the earnings go, so will the price over the long term.

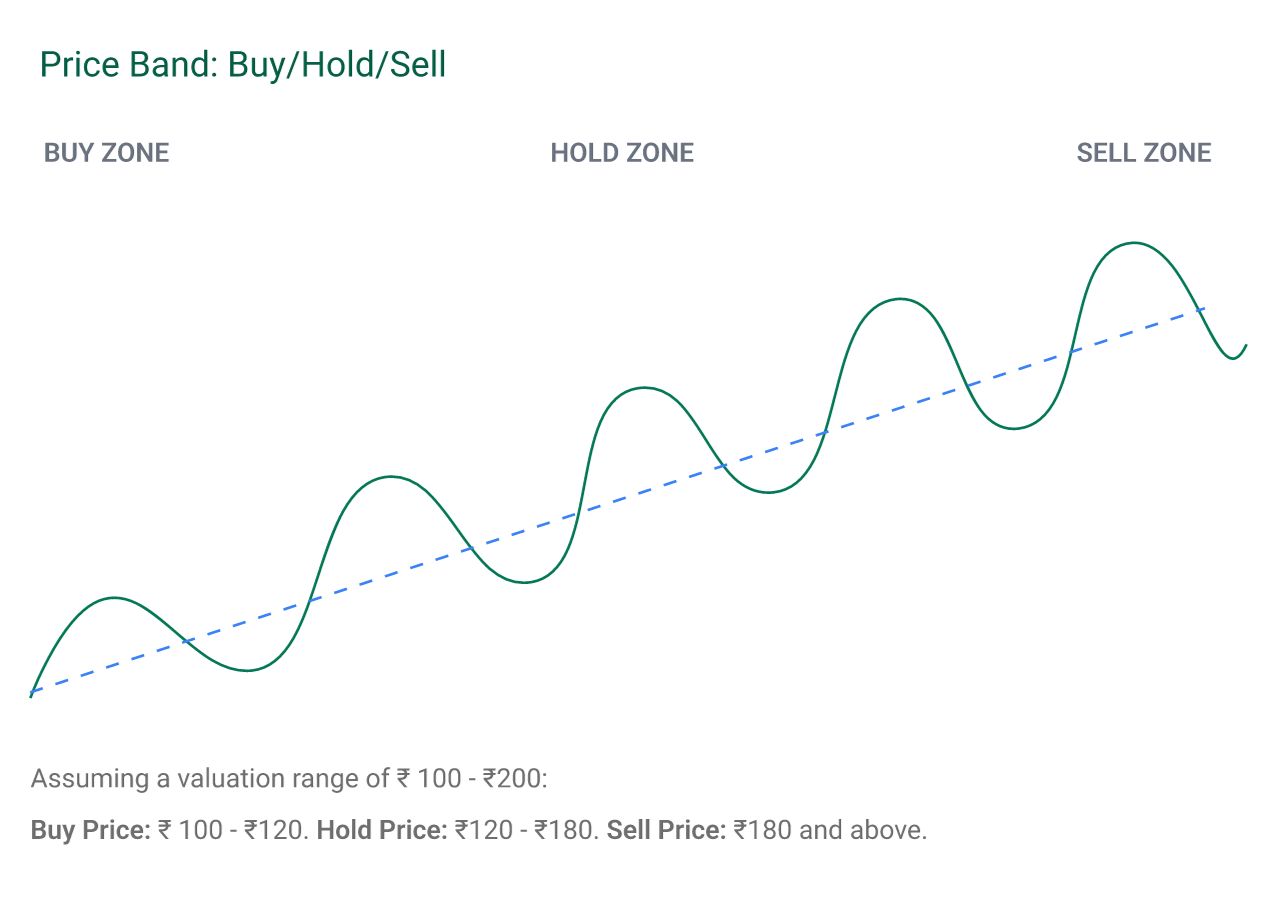

However, high quality stocks tend to trade in valuation bands, fluctuating between the lower end of the band and a higher end of the band depending on pessimism and optimism in the market. It’s not to say that these bands don’t get violated – they do, at the extremes for usually short periods of time. However, they usually bounce back into those bands.

We aim to buy at the lower end of this valuation band and aim to sell at the higher end of this valuation band. This is not as easy as it sounds. We must remember that when a stock is trading at the bottom end of the valuation band, there is usually a reason for it. Possible reasons for the stock trading low are:

- The whole market is down which can happen for a variety of reasons

- The market perceives that there is a problem with the sector

- The market perceives that there is a problem with the company itself

At this point, we need to answer one critical question – is there permanent damage to the business model of the company? If our research indicates that the business model is intact and the problems that the company faces are temporary in nature, we would then consider the stock attractive to buy. At this juncture, the news out there is going to be terrible and many of one’s acquaintances will question one’s sanity in holding on to that stock. It is then the courage of one’s conviction that counts.

Our sell side discipline is the inverse of our buy side discipline. As a stock moves significantly below its intrinsic value (the lower end of our valuation band), we are looking to buy the stock and as it moves significantly above its intrinsic value we will look to sell the stock.

We must remember though, that selling is more an art than science. It is possible that Mr. Market’s mania may drive prices even higher than the price at which we sell. The benefit of selling a stock that is significantly above its estimated intrinsic value is that you are consequently reducing risk in the portfolio. It is possible that we may end up leaving a lot on the table when we exit and we are perfectly ok with that. The reason is that a sale of a stock allows us to look for alternative opportunities that may offer a better reward to risk ratio over the long term.

On this page