August 2024: BSE500 constituents trading at elevated valuations

In 2024

- December 2024: The primary market – the raison d’être of the secondary market

- November 2024: A glimpse into Sep-24 quarterly earnings

- October 2024: Weak Market Internals

- September 2024: Implications of Fed rate cut

- August 2024: BSE500 constituents trading at elevated valuations

- July 2024: Higher taxation to impact intrinsic value

- June 2024: Risks to the market and our process to handle them

- May 2024: Corporate Results Trends over the last 10 years

- April 2024: Our investment process explained through AMCs

- March 2024: Market cap to GDP – where is India in terms of valuation

- February 2024: Patience – a virtue in the investment journey

- January 2024: Party continues for mid caps, small caps and PSUs

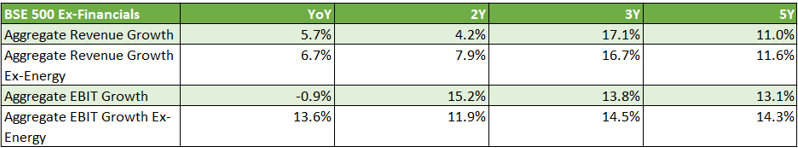

As we do periodically, we review the quarterly results for the BSE500 ex-financials. The aggregate year-on-year (yoy) growth numbers are a bit surprising. Revenue growth for the quarter ended 30 June 2024 is 5.7% yoy and the EBIT growth is -0.9% yoy. Aggregate revenue growth has been sluggish since June 2023. EBIT growth although weak on aggregate, came in at a decent 13.6% yoy if we exclude the energy sector (which saw a big negative growth number). Even the aggregate number looks decent if we look at 2Y, 3Y and 5Y comparisons.

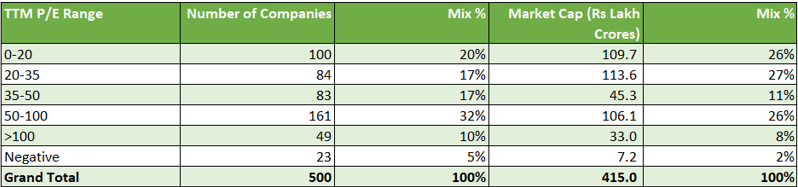

Now, we have a look at the Trailing Twelve Months (TTM) Price to Earnings Ratio (PE) for the different constituents of the BSE500 as on 31 August 2024.

First, we have the distribution in terms of the number of companies trading in a certain PE range and then we have what is the market cap that these companies represent as of today. We have divided the PE ranges into round numbers to give a general idea. Surprisingly, 47% of the BSE500 companies are trading at a PE ratio higher than 50 and this cohort represents 36% of the market capitalization of the BSE500. The median of the PE ratios of all the constituents of the BSE500 as of 31 August 2024 is 44.

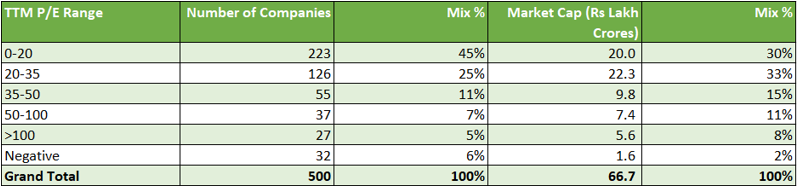

We then turned our attention to the last time in our history when valuations were so high, which was Jan 2008 during the great bull run preceding the Global Financial Crisis. The below table shows the distribution of PE ratios of different constituents of the BSE500 back then. Please note that these are not the same companies because, at different points, companies enter an index when their market caps increase, and many others exit the index when their market caps fall; hence the constitution of the index changes over time.

As we can see, there is a much larger proportion of companies today that are trading at elevated valuations based on their Trailing Twelve Months (TTM) PE ratio than there were at the peak of the bull run which peaked in Jan 2008. Another caveat here – the TTM PE of Jan 2008 is based on March 2008 annual profits, while the August 2024 value is based on TTM earnings reported for June 2024. In Jan 2008, only 19% of companies by number and 22% of companies by total market cap were trading at a PE higher than 50. The median of the PE ratios of all the constituents of the BSE500 in the Jan 2008 peak was 21.

Now 50 is a very high PE on an absolute basis – for reference, the Magnificent Seven in the US have a median TTM PE multiple of 35. When such a large percentage of the BSE500 is trading at such elevated valuations, it is no surprise that we are finding very few opportunities to buy stocks in our quality universe as well. Such high valuations for such a broad spectrum of stocks also pose risks in terms of the return investors can expect from here. It looks a little like the Cinderella Ball, where everyone knows that at some point the stagecoaches will turn to pumpkins, at the stroke of midnight but there are no clocks on the wall.

There are other signs of market exuberance. For instance, a 2wheeler retailer with 2 show rooms did an IPO on the SME exchange. The company, Resourceful Automobile with 8 employees, did an IPO for 12cr and the IPO was oversubscribed 400 times. We have tried to stay clear of the mania prevailing in the Indian market as per our process and wherever we have found that valuations are excessive, we have reduced positions or even sold out of some positions completely. While our attempt is to redeploy these sales proceeds into other stocks in our universe, which may be trading at reasonable valuations, such opportunities have totally dried up in the last few months. As a result, we have some cash lying in our portfolio accounts, which we are keeping in FDs/Liquid Funds. We want to reiterate that the cash in the portfolio is not a macro call but just a resultant of the lack of opportunities to buy within our universe. We hope to utilise this cash as and when prices correct or we get some fresh opportunities within our universe.