February 2025: Indian equity market falls for 5 consecutive months

In 2025

- March 2025: FY2025 – a tale of two halves

- February 2025: Indian equity market falls for 5 consecutive months

- January 2025: Returns in Indian equities compensate for rupee depreciation

The Indian equity market has seen a severe sell-off over the last 5 months. The Nifty50 peaked at 26,277 on 26-Sep-2024 and is now down 15.8% from there. The Nifty500, the Nifty Mid Cap 150 and the Nifty Small Cap 250 indices too are down 19.1%, 21.2% and 25.9% respectively from their peaks.

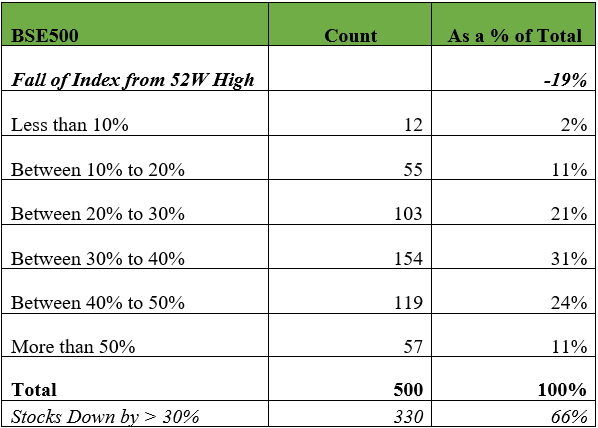

The fall in the Nifty to some extent, hides how badly investors have been hurt over the last 5 months. The table below shows the fall from their respective peaks for the constituents of the BSE500 index.

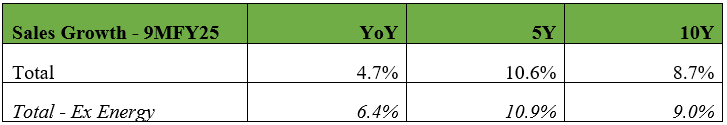

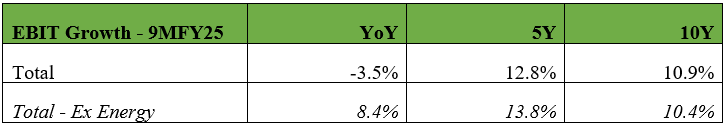

As we can see, the market fall has been severe. We believe that there are two large reasons for this fall – one is that the valuations of the broad market, particularly the mid caps and the small caps were egregiously high (we spoke about this in our August 2024 newsletter). The second reason is that corporate results in the current financial year have been poor. Below we present the results for the nine months ended 31-Dec-24 for the BSE-500 ex-financials. Since we also wanted to look at 5Y and 10Y growth, we have included in the sample only those companies whose numbers are available for the FY2015 as well.

The results for the first 9 months of the poor in terms of revenue growth. Aggregate profit growth is a negative number, though if we exclude the volatile Energy sector, there is some growth. On a 5Y and 10Y basis, though the numbers are better than those on yoy basis, but they are still on the lower side, when compared to prior history.

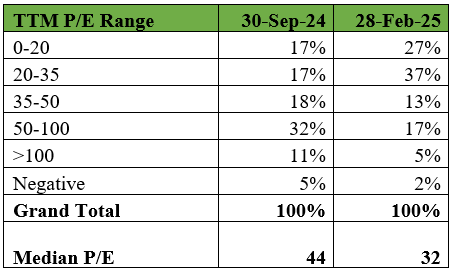

In our 31 August, 2024 newsletter we presented a table showing the proportion of the BSE500 companies trading at different PE ranges. We now present the same table as on 28-Feb-25 compared to 30-Sep-24, which was close to the peak of the Nifty50.

As we can see from this table, the median PE of the BSE500 constituents has come off from its high in September 2024. Also, a larger proportion, at 64% of the BSE500 is now trading in the 0-20 and 20-35 PE range, put together. Thus, a larger proportion of the BSE500 is now trading within a more reasonable valuation band than before. The last 5 months have been a bit of a carnage, particularly in the broader market, with 66% of the BSE500 constituents down more than 30% from the peak. We have utilized this opportunity to deploy some of the cash that we were holding, to buy into select high quality stocks that we believe are trading at reasonable valuations. Can the market fall further? The valuations are still not at rock bottom – so it certainly can. The market has now fallen for 5 consecutive months, something that is rare. When one witnesses such a fall, many stocks which were not that expensive to begin with, can come within the buy zone. Our discipline is to look bottom-up at stocks within our high-quality universe and buy stocks which are trading at reasonable valuations. This is a continuous process and we expect to continue on that path.