Jan 2025: Returns in Indian equities compensate for rupee depreciation

In 2025

- Jan 2025: Returns in Indian equities compensate for rupee depreciation

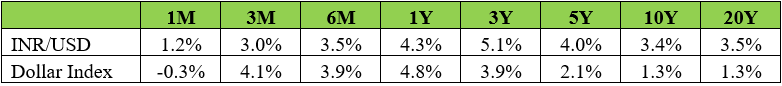

The rupee has had a rough ride over the last few months. It has fallen 1.2% over 1 month and 3.0% over the last 3 months. The volatility in the rupee often unnerves investors, particularly those who are non-residents. We will try to explore long term depreciation of the Indian rupee over time, why it happens and what are the implications.

Below we present the depreciation of the Indian rupee against the US dollar over different time periods. We have also indicated the performance of the dollar index. The Dollar Index (DXY) is a measure of the value of the US dollar relative to a geometric average of six major world currencies with the following weights- Euro (57.6%), Yen (13.6%), Pound (11.9%), Canadian Dollar (9.1%), Swedish Krona (4.2%) and Swiss Franc (3.6%).

As we can see, a large part of the movement of the rupee to the dollar is tied to the general appreciation of the dollar against other currencies as well. What we also find is that the rupee has depreciated against the US dollar at 3.4% and 3.5% pa over 10 and 20 years respectively and over both 10 and 20 years, the dollar index has itself appreciated at 1.3% pa.

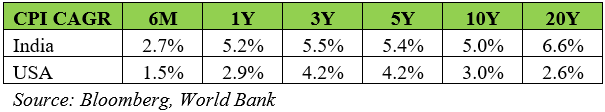

When we look into economic theory, we find that the depreciation of a country’s currency vis-à-vis another country is linked to the inflation differential between the two countries, with the currency of the country having higher inflation depreciating against the other currency.

Below we look at the Consumer Price Index (CPI) inflation in India and US:

Please note that in the table above India CPI inflation prior to 2012 is a different series and may not be strictly comparable. While US inflation has been relatively higher in recent years, over 20 years, the rate of inflation in the US is 2.6% and in India it is 6.6%. Over 10 years, inflation in US is at 3% and Indian inflation is at 5%. So, long term inflation in India is higher than the US by 2-4% depending on the time frame. This is in line with the 3.4% and 3.5% depreciation that the rupee has experienced against the dollar over 10 and 20 years respectively.

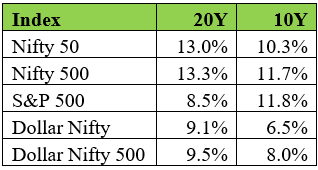

While investing in India, non-residents need to bake in this 3-4% long term depreciation in the rupee. This depreciation is a bit lumpy – high in some periods, and benign in others. Also, the higher inflation in India which is responsible for the currency depreciation, results in higher nominal GDP growth in India to that extent. Nominal GDP growth is real GDP growth plus the GDP deflator which is a proxy for inflation. As we have discussed in the past, the long term return from equities in India is closely linked to the nominal GDP growth of the country. So, to a large extent, the higher depreciation in the rupee reflects in the higher nominal GDP growth which in turn reflects in the higher return that one expects in India. While we are aware that returns over the last few years in the US have been very strong, we need to look at longer term returns to arrive at a conclusion.

Please note that the Dollar Nifty500 doesn’t actually exist as an index – we have used the USD/INR rates and calculated this ourselves. To that extent it is an approximation. As we can see, the 20Y return in the dollar Nifty and the dollar Nifty500 are higher than the S&P500, which happens to be the strongest international equity market. Thus, we believe that both India and US represent attractive equity markets over the long term. So, while rupee depreciation is a bit unnerving when the rupee is volatile, over the long term, the equity returns in India compensate for this rupee depreciation.