January 2024: Party continues for mid caps, small caps and PSUs

In 2024

- December 2024: The primary market – the raison d’être of the secondary market

- November 2024: A glimpse into Sep-24 quarterly earnings

- October 2024: Weak Market Internals

- September 2024: Implications of Fed rate cut

- August 2024: BSE500 constituents trading at elevated valuations

- July 2024: Higher taxation to impact intrinsic value

- June 2024: Risks to the market and our process to handle them

- May 2024: Corporate Results Trends over the last 10 years

- April 2024: Our investment process explained through AMCs

- March 2024: Market cap to GDP – where is India in terms of valuation

- February 2024: Patience – a virtue in the investment journey

- January 2024: Party continues for mid caps, small caps and PSUs

The market over the last year has been quite strong – the Nifty is up 21.6% yoy while the Nifty Midcap 150 index is up 50.9% and the Nifty Smallcap 250 index is up 56.2%. We had spoken in September 2023 about the strong inflows into mid cap and small cap mutual fund (MF) schemes. The momentum on that side continues and mid cap funds and small cap funds together received 38% of the total equity MF inflows during the current financial year. This is significantly higher than in the past. Since the stocks that qualify as mid-caps and small caps constitute only 26% of the market capitalisation on the Indian bourses, there is a lot more money chasing stocks in the mid cap and small cap space. As a consequence, small caps and mid-caps have had a very good run in the Indian market over the last 12 months. This is somewhat contrary to what’s happening in the US, where the move has largely been led by the mega caps, popularly known as the Magnificent Seven – ie Amazon, Apple, Google, Meta, Microsoft, Nvidia and Tesla. The Russell 2000, which represents smaller companies, has not done nearly as well as the S&P500 over the last 12 months. While the S&P is up 20.8% over the last 12 months, the Russell 2000 is up only 3.3%.

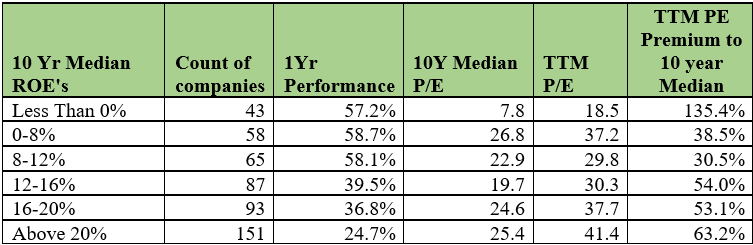

We looked at the BSE500 index and divided it into buckets based on their return on equity (ROE) and compared their returns over the last 12 months. The quality of most businesses can be judged by their return on equity as one of the primary indicators, though of course there are other indicators as well. Below we have tabulated the results of our study:

As we can see, the companies with high ROEs have had relatively muted returns compared to the companies with lower ROEs.

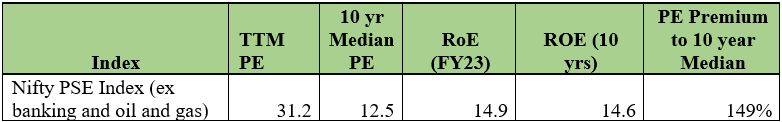

Another segment of the market which has seen a flurry of action is the PSUs. We looked at the constituents of the Nifty PSE (Pubic Sector Enterprises) Index. Within this, we excluded the banks and the oil and gas companies – banks because their earnings are recovering from the collapse a few years ago and the oil and gas sector because fuel prices have not been revised for an extended period and is subject to government policy. So in both cases, current year profits are not comparable with the 10 year medians.

What we find here, is that while the median Return on Equity (ROE) of this set is almost the same as the last 10-year median, their Trailing Twelve Months (TTM) PE is a good 149% above the 10-year median. Many of these PSU stocks, after remaining largely ignored for several years, are in the lime light and regularly feature in the top 10 traded stocks of the day.

In all, the market remains quite strong and is trading at elevated levels compared to history. The rally seems to be stronger in companies with lower ROEs than among those with higher ROEs, which is a bit of a sign of worry. We advise caution to investors with regard to their mid cap and small cap holdings, particularly in those instances where the quality of the business may be poor or the valuations may be elevated as compared to history. We have used the strong market conditions to reduce our weights in some of our portfolio holdings or even fully exit some of them and our effort is to redeploy these sales proceeds into other high quality stocks in our investment universe, which may still be available at reasonable valuations. If we are not able to find adequate opportunities, the money stays as cash in the account, waiting for an appropriate opportunity.