March 2022: CRB Commodity Index at a multi decade high

In 2022

- December 2022: 2022 – a year of outperformance by Indian markets

- November 2022: Tracking recent Indian IPOs

- October 2022: AMCs – Growth at a reasonable price

- September 2022: Dollar surges as the US Fed raises interest rates

- August 2022: Corporate profit growth slows in the June 2022 quarter

- July 2022: Valuations at point of entry determine subsequent returns

- June 2022: Commodities cool off

- May 2022: Inflation – a headwind for corporate profits and markets

- April 2022: HDFC Bank and HDFC Limited Merger

- March 2022: CRB Commodity Index at a multi decade high

- February 2022: Two tiered market

- January 2022: Inflation spooks “growth” stocks

We have been talking about the rising inflation globally in our prior newsletters and we would like to talk a little more about that. The latest inflation reading for the month of February 2022 in the US came in at 7.9% – there has been a relentless rise in reported inflation in the US with each tick coming higher than the previous month. Inflation in the US, UK and Europe are at multi decade highs. While there has been some impact on inflation because of supply bottlenecks, there has also been a substantial rise in price of global commodities over the last 12 months.

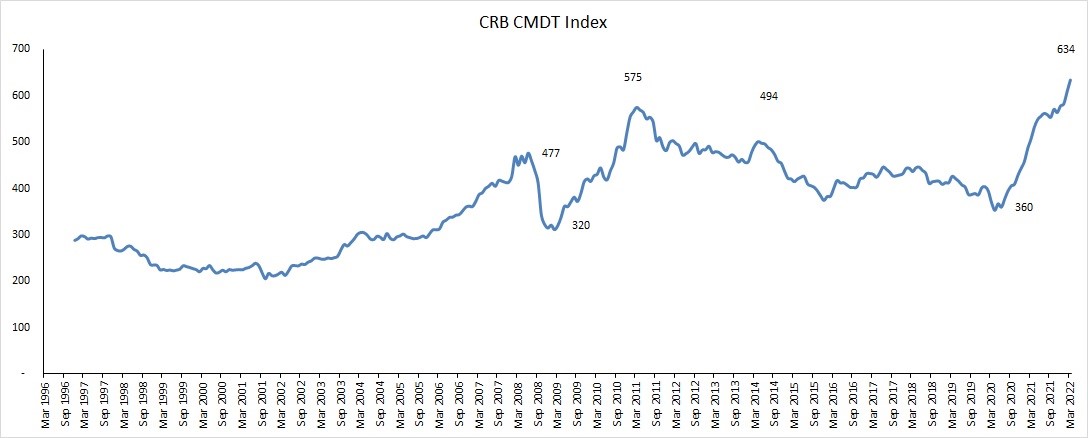

The CRB Commodity Index is an index of 19 commodities and acts as a representative indicator of global commodity markets. Below is its long tail data going back 25 years or so.

There has been a sharp rise in commodity prices over the last 12 months as lockdowns have eased globally and the economy is heading to a more normal trajectory. Below are the 12-month changes in select commodities over the last 12 months.

| Commodity price change | 12 months |

|---|---|

| Brent Crude | 68.5% |

| Gold | 13.1% |

| Aluminium | 61.6% |

| Copper | 17.9% |

| Cotton | 74.5% |

| Sugar | 31.1% |

| Wheat | 66.9% |

As can be seen from the chart of the CRB Commodity Index, we have seen two large spikes in commodity prices over the last 25 years – the previous episode was around 2010 and in the current episode, the index has crossed its prior 2010 high. Some observers have commented that the rise in energy prices as well as in industrial metals are linked to the phenomenon of “greenflation”. This term refers to the rise in inflation in certain commodities because of a lack of investment over the last several years in these sectors due to ESG (Environmental, Social and Governance) concerns. Food prices too are at multi year highs and some analysts have said that this could be an impact of climate change on production of these commodities.

It is perhaps no coincidence that the big rise in the CRB index on both occasions (ie 2010 and now) has happened after a heady dose of “money printing” or quantitative easing (QE) done by the global central banks in response to a crisis. In 2008-09 the QE was done to fight the global banking crisis and this time it was done in response to covid. The US Fed’s balance sheet is approximately $8 trillion now and most of the large global central banks have done their version of quantitative easing in their battle against the covid crisis.

What has perhaps further fuelled inflation in commodities is the large stimulus given by governments around the world on the fiscal side to soften the impact of covid and the related lockdowns on the lives of people. In a world where fiat money is supplied in ever increasing quantities to combat a crisis, it is perhaps natural that things which are limited in supply (such as commodities) will go up with reference to the fiat money.

The underlying strength in commodities over the last 12 months was further aided by the war in Ukraine as the West has imposed harsh sanctions on Russia because of its invasion of Ukraine. Russia is a key producer of several commodities, especially oil, natural gas and wheat. Towards the end of March 2022, there was some progress in the peace talks between Ukraine and Russia and there was a resultant fall in commodity prices. One hopes that the peace talks will gain further momentum in the days to come.

Inflation affects the economy in two ways – one is that it reduces the purchasing power of the consumer to consume goods and services, as their incomes are typically not growing at the same rate as inflation. For individual companies, the effects of inflation may vary – companies which have a strong competitive edge or moat, will be able to pass on the inflation in their inputs, to their customers – companies with a weak competitive advantage, may struggle to do the same.

The second impact of inflation is that it forces central banks to raise interest rates in an effort to fight inflation and inflationary expectations. This affects demand in the interest rate sensitive sectors of the economy. The US Fed has raised the Fed funds rate (the rate at which it lends to banks) by 25 basis points at its latest policy meeting and has indicated 6 similar increases in 2022. Many analysts are commenting that the Fed is behind the curve in raising rates as inflation spikes – the US 10 year bond yield has risen by about 100 basis points since October 2021. A corollary impact of rising interest rates, is that it affects the valuation of companies because interest rate is in the denominator in the calculation of intrinsic value of a company.

We are mostly invested in companies with a strong competitive edge and these businesses should largely be able to pass on the input cost inflation to their customers over time. We have also cut down our positions or exited completely the companies which were trading at the higher end of their valuation ranges. We therefore feel that the portfolio is well positioned to ride out the inflation related uncertainties that may unfold.