Growth has slowed over the last 4 years

In 2023

- December 2023: HDFC Bank- when elephants dance

- November 2023: Corporate growth over the medium and long term

- October 2023: Margin of Safety – central to investing

- September 2023: Mid-caps and small caps are quite the rage in Indian markets

- August 2023: A look at the June 2023 corporate results

- Will the US economy have a soft landing?

- Nifty at an All Time High

- Growth has slowed over the last 4 years

- Competitive edge is at the heart of company selection

- As banks fail around the world, Indian banks seem safe

- Poor corporate governance can invalidate an investment hypothesis

- January 2023: Momentum Investing vs Value Investing

As we are almost done with the corporate results season for the last quarter of the financial year (FY) March 2023, we thought we would have a look at it. If we go back in history, the omicron variant first emerged in India around December 2021 and as it spread, it became the natural vaccine for the populace. It was relatively less virulent and its spread offered herd immunity to the populace at large. So, FY2023 is the first financial year where covid was largely absent and a comparison of these results with FY2019, a pre covid year could be interesting.

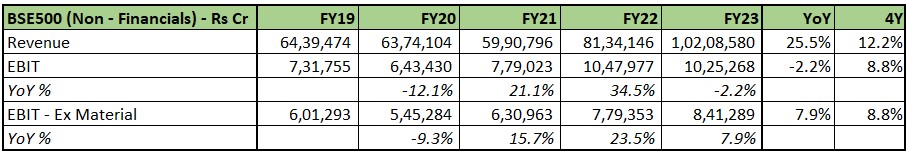

As usual, we looked at the non-financials segment of the BSE500 to gauge corporate performance. 405 out of the 433 non-financial companies in the BSE500 have reported results so far and they represent ~97% of the market cap of the BSE500 (non-financial).

The first thing we notice is that despite strong revenue growth, EBIT growth YoY for the sample set is negative. The material sector (mineral & mining, steel, chemicals, sugar, etc.) is a large contributor to the negative growth, and ex-material, the EBIT growth is a more reasonable 7.9% YoY. EBIT grew very strongly in FY2022 at 34.5% YoY aided by the material sector, and ex-material, the growth rate was still strong at 23.5% YoY.

Then we look at the 4-year picture to get a view of pre-covid to now – Total revenue growth is 12.2% and EBIT growth is 8.8%. EBIT growth, though muted compared to history, is perhaps understandable considering the ramifications of covid and the strict lockdowns.

Now we turn our attention to the GDP data which got released today. Real GDP growth for the quarter Q4 came in at 6.1% and for the year FY23 at 7.2%. While the GDP growth for FY2023 appears reasonably strong, there is a base effect at play here. In FY2022 the first quarter saw the impact of the second wave of covid and in FY2021 we had the first wave of covid. Hence the base effect distorts the image. When we look at the 4-year CAGR of real GDP growth, to eliminate the base effect, the number is 3.4% for real GDP growth and the nominal GDP has a CAGR of 9.6%.

Growth has been slow over the last 4 years compared to history, both for GDP as well as for corporate profits. The pandemic and the resultant lockdown have impacted the economy, which is visible in the numbers. With the pandemic now out of the way, a large clean-up of the corporate sector through the Insolvency and Bankruptcy Code, and a number of reforms like GST and RERA implemented, one can perhaps look forward to better GDP growth and corporate growth in the years ahead.