October 2024: Weak Market Internals

In 2024

- December 2024: The primary market – the raison d’être of the secondary market

- November 2024: A glimpse into Sep-24 quarterly earnings

- October 2024: Weak Market Internals

- September 2024: Implications of Fed rate cut

- August 2024: BSE500 constituents trading at elevated valuations

- July 2024: Higher taxation to impact intrinsic value

- June 2024: Risks to the market and our process to handle them

- May 2024: Corporate Results Trends over the last 10 years

- April 2024: Our investment process explained through AMCs

- March 2024: Market cap to GDP – where is India in terms of valuation

- February 2024: Patience – a virtue in the investment journey

- January 2024: Party continues for mid caps, small caps and PSUs

We have spoken in the past about the high valuations of the market particularly with respect to the mid-caps and small-caps. In March 2024, we wrote that the market cap to GDP ratio of the Indian market was 135% which was close to the 149% in the 2007-08 market peak. On 30 September 2024, this number was at 155%. In August 2024, we wrote about the high valuations of the broad market. One statistic we presented there was that 47% of the BSE500 Index was trading at more than 50x Trailing Twelve Month (TTM) Earnings in terms of its Price to Earnings ratio. On 30 September 2024, this number stood at 45%.

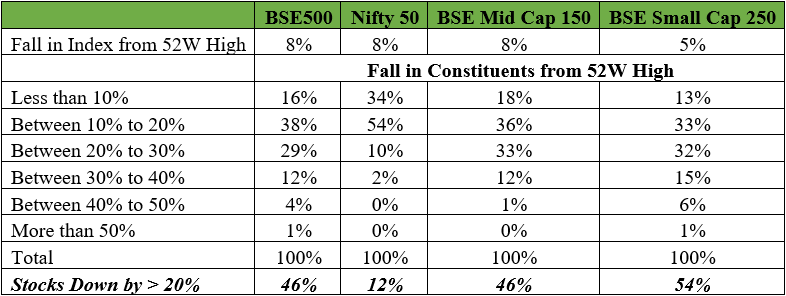

October was a month of correction for the market – the Nifty fell 6.2%, the BSE500 fell 6.5%, the BSE Midcap 150 fell 7.2% and the BSE Small Cap 250 fell 4.1%. Below we present the fall from 52-week highs of constituents of different indices and sub segments of the market:

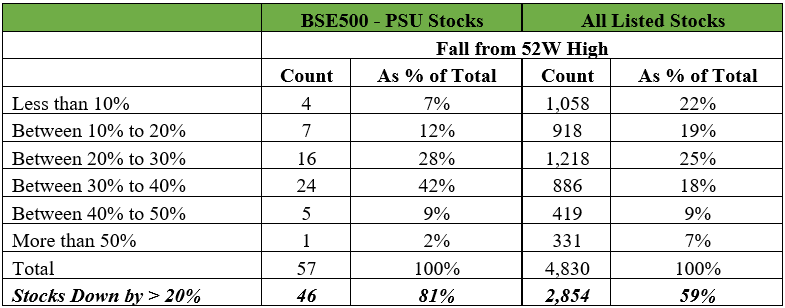

As is clear from above, while the indices are not down that much, there has been a lot of damage to the internals of the broad market. The constituents of the Nifty has been saved the blushes to some extent. The percentage of the constituents in the different indices which are trading more than 20% below their highs, is particularly worth paying attention to. This is not entirely unexpected given the high levels of valuation of the market over the last few months. PSU stocks, which have had a massive run over the last year or two, have been particularly hit. On top of that, the early quarterly results have not been very encouraging. We will do a detailed analysis of the results at a later date, when all companies have reported, but the early signs are not good in terms of corporate performance.

As we have mentioned in the past, we have been reducing or completely selling some of our positions over the last several months. While our effort usually is to deploy the sales proceeds into other stocks in our high-quality universe which offer a good risk reward, those opportunities had really dried up. We reiterate here that the quantum of cash and cash equivalents in the portfolio is not linked to any sort of macro or market call. It is simply the lack of opportunities within our universe at the prices that had been prevailing until 30 Sep 2024. The correction in the market, over the last month because of its internal breadth and severity, is throwing up some potential opportunities in the near term. We hope to find some more of those over the next few months.