September 2022: Dollar surges as the US Fed raises interest rates

In 2022

- December 2022: 2022 – a year of outperformance by Indian markets

- November 2022: Tracking recent Indian IPOs

- October 2022: AMCs – Growth at a reasonable price

- September 2022: Dollar surges as the US Fed raises interest rates

- August 2022: Corporate profit growth slows in the June 2022 quarter

- July 2022: Valuations at point of entry determine subsequent returns

- June 2022: Commodities cool off

- May 2022: Inflation – a headwind for corporate profits and markets

- April 2022: HDFC Bank and HDFC Limited Merger

- March 2022: CRB Commodity Index at a multi decade high

- February 2022: Two tiered market

- January 2022: Inflation spooks “growth” stocks

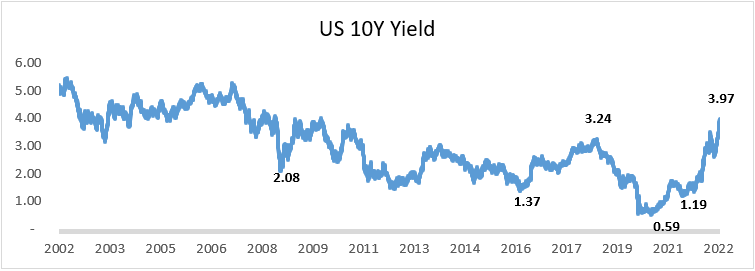

Last month we spoke about how Jerome Powell, the Chair of the US Fed had indicated at the Jackson Hole Symposium that the Fed remained very concerned about inflation and more importantly inflationary expectations. The Fed raised interest rates by 75 basis points for the third consecutive meeting. As the Fed has raised interest rates to fight inflation over the last several months as also started its Quantitative Tightening (QT) program, there have been several consequences of the same. One, we have seen interest rates harden all across the yield curve in the US and the 10-year US bond yield hit close to 4% recently from its 52 week low of 1.34%. When yields on bonds go up, the price of the bond falls – we have seen severe losses suffered by bond holders in the US and across the globe. The second impact of the fight against inflation is the strengthening of the US dollar across most major currencies.

The rupee too has taken a hit against the dollar – below is a table of how the rupee has appreciated/depreciated against different currencies over the last 12 months with a positive number indicating appreciation and a negative number indicating depreciation.

| 1Y % | USD | GBP | EURO | YEN | YUAN |

|---|---|---|---|---|---|

| INR | -9.3% | 13.2% | 8.9% | 17.2% | 0.1% |

The RBI has been selling dollars from its forex reserves to stabilize the rupee and India’s forex reserves are down by $91bn over the last 12 months. Looking at the strength of the US dollar over the last 12 months against all major currencies, and the appreciation of the rupee against most currencies other than the dollar, one wonders whether it is wise to fritter away precious foreign exchange trying to defend the rupee against the dollar. When the RBI sells dollars, it is buying rupees – so this foreign exchange intervention by the RBI has also resulted in liquidity tightening in India.

In an environment like this, where central banks around the world are raising interest rates and also reducing their balance sheet through QT, and a consequent flight to the US dollar, it behooves investors to be cautious in their outlook over the short to medium term. What further adds to our caution is that valuations of most high-quality companies in India are elevated. As we said in our newsletter last month, we expect markets to remain volatile over the short term – that said, past experience tells us that such periods of high volatility also throw up good opportunities for the patient investor.