November 2022: Tracking recent Indian IPOs

In 2022

- December 2022: 2022 – a year of outperformance by Indian markets

- November 2022: Tracking recent Indian IPOs

- October 2022: AMCs – Growth at a reasonable price

- September 2022: Dollar surges as the US Fed raises interest rates

- August 2022: Corporate profit growth slows in the June 2022 quarter

- July 2022: Valuations at point of entry determine subsequent returns

- June 2022: Commodities cool off

- May 2022: Inflation – a headwind for corporate profits and markets

- April 2022: HDFC Bank and HDFC Limited Merger

- March 2022: CRB Commodity Index at a multi decade high

- February 2022: Two tiered market

- January 2022: Inflation spooks “growth” stocks

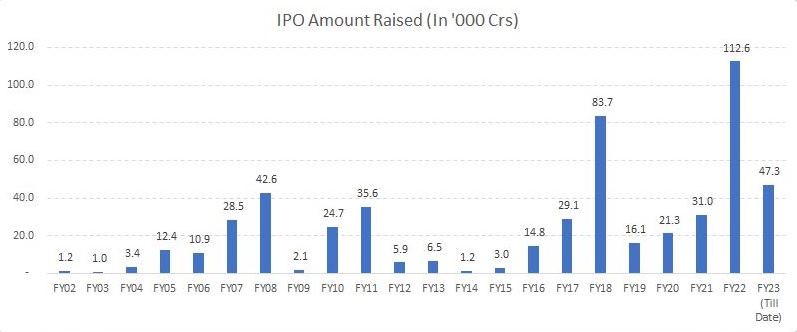

With all the news around Paytm being the worst performing large IPO in the world over the last decade swirling around, we thought we will look at the IPO market in India over the last 2 years to see if we could discern some patterns therein. But first, a look at the total amount raised from IPOs over the years.

It appears from this table that more money gets raised from IPOs when markets are buoyant.

While studying the IPOs of the last 2 years and their performance from the IPO price to date, we find that the median IPO has delivered a 17.4% return since listing (where the IPO is listed less than a year back, we have taken only the absolute return – else we have taken CAGR returns). Within these, we divided the universe into 2 sets – companies that reported a net profit in the financial year prior to listing and those that reported a loss. We find that while the median profitable company delivered a 20.3% return, the median loss-making company delivered a negative 12.4% return.

When we dig deeper into the set of companies which had made a loss in the year prior to listing, we find that the worst returns, ranging from -12.4% to -76.5% are for tech start-ups, while the positive returns are largely concentrated among stocks belonging to the “Consumption” sector. One of the reasons for the poor performance of the loss-making tech start-ups is a similar trend in the Nasdaq where over the last 12 months or so, loss making technology companies have had sharp falls and the Nasdaq 100 is down 31.4% from its peak.

While we have no comment to make on the viability of these loss-making tech companies who have long had a philosophy of cash burn, to drive exponential growth, we have a strong belief that we want to invest in companies which generate a good ROE or at least are demonstrating a path towards generating a healthy ROE. There are multiple ways to make money in the markets – we simply follow what we believe in. We were asked in the past by some of our investors whether we would like to invest in these “hot” technology IPOs – our stance then was the same as it is now. As a rule, we find that IPOs usually come to market when the timing is favourable for the seller rather than the buyer and it is rare to find an attractively priced IPO. Even in the instance that an IPO is attractive from the price point of view, it will usually get subscribed a large number of times giving one a very poor allotment ratio, making the whole exercise unviable. So, we prefer to evaluate these stocks when they get listed and if they meet our criteria for a quality company, they get added to our universe of quality stocks.